AI Price Optimization: Why Traditional Pricing Logic No Longer Works

Table of Contents

- Introduction

- What is AI Price Optimization

- How Does AI Set Better Prices Every Day

- How Are AI-Driven Pricing Solutions Delivered

- Key Components That Strengthen AI-Driven Pricing

- Difference Between AI Price Optimization and Manual and Rule-Based Pricing

- Industries Benefitting from AI Price Optimization

- Business Use Cases

- How Connected Platforms Support Accurate Pricing Decisions

- Conclusion

Pricing has become one of the most sensitive points of control for modern businesses. Leaders face shrinking margins, volatile demand, and rising competition, all while customers expect fair and timely prices across every channel.

These pressures grow sharper in e-commerce and retail settings. Teams deal with frequent catalog changes, inventory swings, and rapid market shifts. Manual pricing reviews fall behind these patterns, which leads to inconsistent decisions, revenue loss, and operational fatigue.

Retail studies support this shift. Insights from BCG show that retailers adopting AI-powered pricing systems recorded a 5 to 10% improvement in gross profit along with notable revenue growth.

AI price optimization steps in to bring order to these moving parts. It reads demand in real time, studies customer signals, and supports pricing teams with steady and accurate recommendations. Leaders gain clearer insight, stronger outcomes, and greater confidence in every commercial decision.

In this blog, we will look at the root causes behind today’s pricing challenges and show how AI offers a structured and future-ready approach.

What is AI Price Optimization?

AI-driven pricing gives leaders a sharp view of how demand, competition, and customer intent shift through the day. It replaces guesswork with steady signals that help teams act with clarity and speed. For business leaders, it brings structure to decisions that once depended on delayed data.

Understanding How Traditional Pricing Works

Most organizations still use methods that struggle with market volatility. These systems fall short because they depend on:

- Periodic reviews.

- Manual spreadsheet updates.

- Isolated market checks.

- Static rules that rarely change.

- Limited visibility on real-time demand.

This slows the pace of decision-making and creates gaps that affect profit.

How Does AI Transform the Pricing Loop?

AI introduces consistency through continuous learning. It evaluates real-time data and reacts with more confidence. Leaders gain:

- Real-time awareness of demand shifts.

- Clear signals on customer intent.

- Better insight into profit drivers.

- Accurate pricing recommendations.

- Faster responses to competitive movement.

This helps businesses act without delay and reduces the risk of margin swings.

Traditional vs. AI-Driven Pricing

| Factor | Traditional Pricing | AI-Driven Pricing |

|---|---|---|

| Decision basis | Past data and static rules | Real-time demand and intent |

| Speed | Slow and scheduled | Continuous and responsive |

| Accuracy | Limited by manual review | Learns from every signal |

| Risk | Higher chance of error | More stable and adaptive |

| Team workload | Heavy manual tasks | Automated support |

This comparison reflects why leaders push for more advanced pricing systems.

Why Smarter Engines Support Growth

As businesses expand their digital channels, the need for stronger pricing logic rises. Leaders want stable performance across online and physical touchpoints. AI supports this need with:

- Real-time commercial visibility.

- Unified pricing logic across channels.

- Better control over margin.

- Consistent decision flow for teams.

This is where price optimization becomes a central priority rather than a back-office task.

How Does AI Learn to Set Better Prices Every Day?

AI-driven pricing grows stronger with each signal it studies. It builds a continuous learning cycle that responds to demand shifts and changing customer intent. This creates a structured pricing flow that supports profit stability and stronger commercial outcomes.

AI Reads Demand PatternsWithPrecision

AI studies several demand indicators at once, forming a clear view of buying intent. It captures shifts that manual reviews often miss. Key signals include

- Customer interest across digital and physical channels.

- Changes in product views during peak hours.

- Stock movement that reflects buying trends.

- Seasonal variation that affects purchase timing.

- Market activity that influences price sensitivity.

This unified view supports pricing decisions that align with live conditions.

Machine Learning Strengthens Pricing Logic

Machine learning forms the intelligence layer behind every strong pricing engine. It learns from past actions and builds models that become sharper with time. It improves pricing by studying:

- Which product ranges respond well to certain price points?

- How does demand grow or drop at specific moments?

- Which patterns repeat in similar buying cycles?

- Where does competition shift influence customer choices?

- What margin levels stay resilient across changing seasons?

This learning cycle reduces the guesswork that once slowed decisions.

Real-Time Data Creates Faster Price Accuracy

Real-time data keeps the pricing engine active throughout the day. It updates recommendations as soon as new signals arrive. This improves stability in e-commerce environments where timing drives conversion.

Retail studies show strong results from AI-driven pricing. Retailers using advanced pricing intelligence have seen revenue growth of up to 10% and margin lift of up to 5%, showing how continuous updates support stronger performance.

The same logic applies across industries with complex demand patterns. The BCG research on retail pricing also supports this view for businesses that want clarity in fast-moving markets.

Connection to Dynamic Pricing Optimization

This continuous learning cycle forms the base for dynamic pricing optimization. It supports price adjustments that respond to demand shifts, competitive moves, and stock changes. Industries with high-frequency decisions, such as airlines and logistics, gain strong value from this model.

Airline research confirms this improvement. Moving from rule-driven pricing to machine learning models increased conversion for ancillary offers by 36% and supported a revenue per offer uplift of 10%, showing how AI sharpens decisions in volatile settings.

How Are AI-Driven Pricing Solutions Delivered?

A strong pricing program follows a structured delivery path. Each stage builds the foundation needed for accurate pricing and stable long-term performance. This approach helps the pricing engine develop the clarity and precision required for daily commercial decisions.

Discovery

Discovery sets the direction for the entire program. Teams review product groups, goals, and pricing challenges. This stage delivers:

- A clear definition of value areas.

- Visibility into pricing gaps and performance issues.

- Alignment on the outcomes that matter most.

BCG reports that 74% of companies struggle to scale AI value because challenges often come from people and processes rather than technology.

Data Assessment

Every pricing model depends on strong inputs. Data assessment reviews the quality of product, demand, and stock information. This process includes:

- Checking data consistency across systems.

- Reviewing historic demand patterns.

- Identifying missing or incomplete signals.

This builds the foundation for accurate pricing logic.

Model Design

Model design creates the intelligence behind the pricing engine. The models reflect real business conditions and learn from past outcomes. This step focuses on:

- Understanding category behavior.

- Mapping demand patterns across seasons.

- Building logic that adapts to future conditions.

It shapes how the system interprets market signals.

Testing

Testing brings stability to the pricing solution. Models are reviewed under live and historic conditions. This phase provides:

- Confirmation of accuracy.

- Validation of model behavior.

- Confidence that pricing will perform as expected.

It reduces risk before the program moves into production.

Integration

Integration connects the pricing engine with ERP, CRM, POS, and e-commerce platforms. This step focuses on:

- Establishing a reliable flow of data.

- Keeping pricing aligned with operational activity.

- Creating timely visibility for pricing teams.

The integration layer supports the daily function of the pricing engine without repeating the deeper technical detail covered in your connected systems section.

Pricing Cockpit Creation

The pricing cockpit provides a single workspace for decision review and approval. It supports:

- Clear visibility into pricing activity.

- Smooth execution of updates.

- Faster alignment across teams.

This gives users a structured environment for their daily tasks.

Continuous Improvement

AI models grow stronger with use. Continuous improvement keeps the pricing engine aligned with real market conditions. This cycle delivers:

- Better recognition of patterns.

- More accurate responses to new scenarios.

- Stronger performance as the business evolves.

It ensures the program grows in value over time.

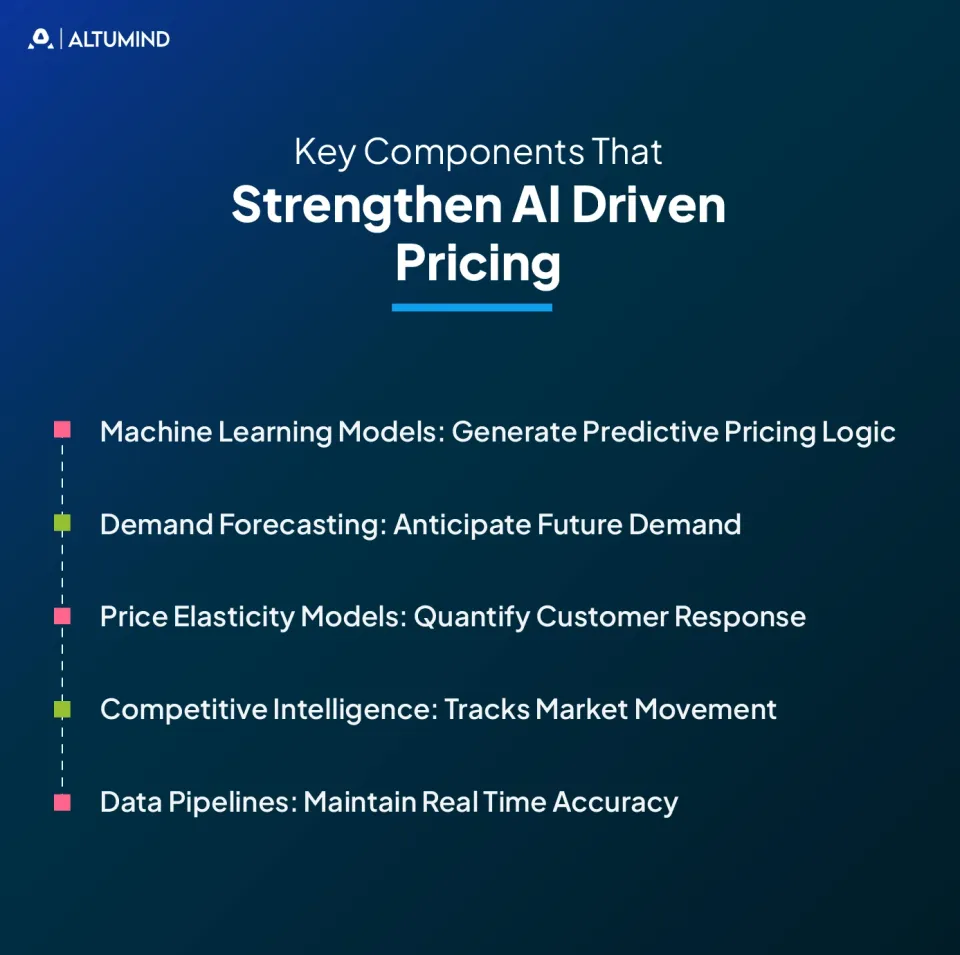

Key Components That Strengthen AI-Driven Pricing

Modern pricing systems use several advanced technologies to read demand, interpret customer behavior, and support accurate decisions. These components work together to create stable margins and reliable commercial performance. Each layer builds the intelligence needed for long-term pricing strength.

Machine Learning Models: Generate Predictive Pricing Logic

Machine learning forms the decision layer of every advanced pricing system. It studies the connection between price, demand, and customer choices. Its main contributions include:

- Recognizing patterns that repeat across buying cycles.

- Predicting demand movements with greater accuracy.

- Studying the performance of previous price points.

- Reading competitive activity for better context.

- Supporting recommendations that stay aligned with real conditions.

This builds a decision flow that performs well even when markets shift.

Demand Forecasting:AnticipateFuture Demand

Forecasting gives the pricing engine a forward view of demand. The forecasting layer draws strength from:

- Seasonal movement and historic buying trends.

- Stock turnover patterns that reflect interest.

- Real-time product activity across digital channels.

- Shifts in customer interest from search and browsing data.

- Pricing events that influence short-term demand.

Studies in airline operations show similar gains, with AI-driven forecasting systems improving accuracy by 14 to 22%.

Price Elasticity Models: Quantify Customer Response

Elasticity models study how buyers react to price changes. These models analyze:

- Sensitivity across different product groups.

- Price points that encourage faster conversion.

- Patterns that reduce the need for deep discounting.

- Thresholds that influence customer hesitation.

- Long-term value based on repeat behavior.

This helps create refined pricing decisions across wide assortments.

Competitive Intelligence: Tracks Market Movement

Competitive intelligence captures real-time market shifts. It focuses on:

- Competitor price adjustments across key channels.

- New product entries that affect demand levels.

- Promotional cycles that change customer attention.

- Market events that alter buying patterns.

- Category trends that shape short-term behavior.

This keeps pricing aligned with market pressure.

Data Pipelines:MaintainReal-Time Accuracy

Data pipelines keep every pricing model active and updated. These systems support:

- Immediate consolidation of demand and stock signals.

- Real-time analysis of customer activity.

- Continuous updates to pricing rules.

- Seamless movement of information across platforms.

- Strong performance for large catalogs.

This forms the foundation that keeps pricing decisions consistent.

Difference Between AI Price Optimization and Manual and Rule-Based Pricing

| Factor | AI Price Optimization | Manual and Rule-Based Pricing |

|---|---|---|

| Decision Source | Real-time signals and continuous learning | Static rules and periodic reviews |

| Speed | Fast adjustments based on live data | Slow updates and long review cycles |

| Accuracy | High precision supported by active models | Limited by human review and outdated inputs |

| Response to Demand | Immediate adjustment to demand changes | Delayed reaction to market shifts |

| Scalability | Strong performance across wide product ranges | Difficult to manage for large catalogs |

| Consistency | Stable decisions created by unified logic | Prone to variation across teams |

| Predictive Power | Strong prediction of future demand | Very limited forecasting ability |

| Margin Stability | Improved stability supported by machine learning | Vulnerable to error and missed signals |

| Competitive Insight | Continuous tracking of market movement | Periodic checks only |

| Operational Load | Reduced workload through automated processes | Significant manual effort |

Industries Benefitting from AI Price Optimization

AI-driven pricing supports several industries that deal with rapid demand changes, large catalogs, and sensitive margin structures. Each sector benefits from real-time insight that brings more stability to commercial decisions.

Retail

Retail operations manage large product assortments and frequent price shifts. AI strengthens retail price optimization by bringing more clarity to decisions that influence margin across high-volume categories. Key advantages include:

- Better response to short-term demand movement.

- Clearer view of product performance through the day.

- Steady margin improvement across key categories.

- More accurate promotion timing.

These gains support retailers facing rising pressure from online and offline competition.

E-commerce

E-commerce operates with real-time buying patterns and heavy catalog activity. AI supports quicker decisions that match customer intent and stock movement. Value highlights include:

- Live adjustment of pricing during peak traffic.

- Better listing performance across fast-moving items.

- Reduced margin loss during promotional periods.

- Improved response to competitive changes.

The role of AI becomes more important as businesses face ongoing challenges in e-commerce.

Manufacturing

Manufacturers work with varied production costs and shifting supply conditions. AI builds a more reliable pricing foundation across complex product lines. It brings support through:

- Stronger understanding of cost variations.

- Clear pricing for multi-tier product structures.

- Better insight into demand cycles for planning.

- Improved stability during raw material changes.

These improvements reduce pricing uncertainty in long supply chains.

Logistics

Logistics companies operate with time-sensitive demand and variable capacity. AI helps maintain balance between demand and available resources. Core benefits include:

- More accurate view of delivery cost shifts.

- Live pricing based on capacity and route activity.

- Better alignment between demand spikes and service load.

- Stable margin across peak time windows.

This creates a smoother pricing flow for both outbound and inbound networks.

Hospitality

Hotels, travel firms, and service providers deal with heavy seasonal movement. AI helps them respond to customer interest with greater accuracy. Key advantages include:

- Better pricing for peak travel periods.

- More precise room or service availability mapping.

- Real-time response to booking patterns.

- Improved visibility on competition within the region.

These insights support stronger yield performance throughout the year.

BFSI

The BFSI sector handles complex pricing structures for loans, insurance, and service fees. AI introduces consistent decision-making across these financial models. It provides support by:

- Evaluating customer risk profiles with more clarity.

- Adjusting price based on demand and risk factors.

- Reducing variation caused by manual review cycles.

- Strengthening product-level profitability.

This precision helps financial institutions bring more stability to revenue programs.

Business Use Cases

AI-driven pricing brings value across several core commercial functions. It supports decisions that influence revenue, margin, and customer response. Each use case strengthens the overall pricing program and creates measurable business outcomes.

Margin Protection

Margin strength depends on precise and timely pricing. AI studies demand signals, stock levels, and customer intent to prevent unnecessary discounting. Key advantages include:

- Better control over price drops during low demand.

- Steady margin performance across product groups.

- Clear response to competitive movement without overreacting.

- Reduced risk of revenue loss during peak traffic.

This creates a more stable commercial foundation through the year.

Unified Inventory Insight

A unified view of stock and its demand and supply supports stronger pricing accuracy. AI connects inventory data with buying behavior to produce structured insights. It improves decisions by:

- Spotting stock pressure before it affects revenue.

- Understanding which items need faster movement.

- Aligning price with real-time supply signals.

- Highlighting products that need controlled pricing.

This helps teams act with more clarity during high-volume cycles.

Automated Price Adjustments

AI updates pricing at the pace of market activity. It interprets demand variation and adjusts price with timely recommendations. This delivers:

- Live adjustment during peak periods.

- Consistent decisions for large product ranges.

- Faster reaction to competitor activity.

- Stronger conversion rates during busy cycles.

This automated flow reduces the effort that teams once spent on manual reviews.

Promotion Refinement

Promotions influence short-term buying behavior. AI studies past outcomes to refine timing, depth, and targeting. It supports:

- Better identification of products suited for promotion.

- Stronger balance between discount and profit.

- Clarity on which customer groups respond well.

- More predictable results during seasonal demand.

These insights reduce the guesswork behind promotional planning.

Digital Workflow Tracking

Pricing affects several functions connected to product updates and channel performance. AI supports these workflows by offering structured insight across touchpoints. It strengthens decisions by:

- Highlighting product-level trends across digital platforms.

- Providing clear visibility into conversion movement.

- Supporting better coordination between pricing and product teams.

- Identifying early signals that impact future updates.

This creates a connected pricing flow that improves overall commercial outcomes.

How Connected Platforms Support Accurate Pricing Decisions

Integrated pricing systems create a unified view across channels. They support real-time decisions by linking pricing logic with major operational platforms.

Integration With ERP, CRM, POS, and E-commerce Systems

These systems supply the core signals needed for accurate pricing. Key contributions include:

- Immediate visibility of orders, stock, and e-commerce and fulfillment status.

- Real-time insight into customer activity across channels.

- Strong performance during promotions and peak traffic.

- Better alignment between online and physical operations.

This unified environment helps pricing decisions reflect what is happening in the business at every moment.

Unified Data for Digital Teams

Digital teams rely on connected information to support catalog updates, product changes, and channel-level strategy. Integrated pricing creates a smoother workflow. It supports:

- Timely updates across digital touchpoints.

- Direct alignment between availability and pricing.

- Better interpretation of customer behavior.

- Clean execution of channel decisions.

These elements strengthen the speed and stability of pricing performance.

Improvement in Pricing Accuracy

Accuracy grows when data moves through a clean and connected pipeline. Integrated systems raise performance by:

- Removing delays from disconnected tools.

- Increasing the quality of demand and stock signals.

- Aligning pricing plans with live activity.

- Supporting models that depend on real-time information.

The same structure also supports functions related to AI in compliance, where reliable data improves decision quality.

Conclusion

AI-driven pricing now stands as a key driver of commercial performance. It gives teams a clear view of demand, customer behavior, and market movement so pricing stays accurate through changing conditions. When supported by integrated systems and structured workflows, it brings stronger margin stability and more reliable decision flow.

Recent findings show that 93% of large companies see AI as essential for future success, yet many still face talent gaps that slow progress. This makes experienced support vital for organizations building advanced pricing programs.

Altumind helps businesses move beyond manual reviews and adopt AI-driven pricing built on accurate models and unified data. Our teams support each stage of the pricing program so decisions perform well in real environments.

Leaders who want a precise and future-ready pricing foundation can connect with Altumind to discuss their goals and understand the path toward a stronger pricing program.

Table of Contents

- Introduction

- What is AI Price Optimization

- How Does AI Set Better Prices Every Day

- How Are AI-Driven Pricing Solutions Delivered

- Key Components That Strengthen AI-Driven Pricing

- Difference Between AI Price Optimization and Manual and Rule-Based Pricing

- Industries Benefitting from AI Price Optimization

- Business Use Cases

- How Connected Platforms Support Accurate Pricing Decisions

- Conclusion

Let's Connect

Reach out and explore how we can co-create your digital future!