Understanding the Growing Influence of AI in Compliance Across Industries

Are compliance teams still drowning in manual documentation, struggling with regulatory changes, and facing mounting pressure to demonstrate governance? Wondering how leading organizations are managing complex compliance requirements while reducing costs and improving accuracy? If these challenges resonate with your organization, then you’ve arrived at the right place! Dive deep into this comprehensive analysis to discover why AI in compliance has transformed from an emerging technology into an indispensable business imperative for organizations competing in today’s heavily regulated business environment.

Organizations embracing AI in compliance realize it’s a technology unlike any other, revolutionizing regulatory adherence with unprecedented efficiency and precision. From automated risk assessments and real-time monitoring to predictive analytics that anticipate compliance violations before they occur, advanced artificial intelligence defines modern regulatory excellence.

The stakes for non-compliance have never been higher. The average cost of non-compliance reaches $14.82 million annually for organizations, while the average cost of maintaining robust compliance programs is only $5.47 million, a nearly threefold difference that demonstrates the financial imperative of proactive compliance management.

Planning to revolutionize your organization’s compliance strategy? No need to worry, we’ve got you covered.

Keep reading, as you’ll explore the growing role of AI in compliance across industries.

Why Do Organizations Need AI in Compliance?

Organizations across industries are discovering that AI in compliance is essential for staying ahead in today’s dynamic regulatory landscape. Recent data shows that 70% of corporate risk and compliance professionals have noticed a shift from check-the-box compliance to a more strategic approach over the past two to three years. The technology offers unparalleled advantages for managing regulatory complexity, monitoring risk exposure, and ensuring consistent policy adherence that traditional manual methods simply cannot match.

Modern regulators expect organizations to demonstrate proactive risk management and real-time compliance monitoring, making AI-driven solutions a critical business tool. The complexity of today’s regulatory environment demands sophisticated technological solutions. Compliance costs for organizations have increased by 60% since the financial crisis of 2008, with regulatory complexity growing by 300% over the past decade. Manual compliance processes simply cannot keep pace with this exponential growth in requirements.

AI Advantages for Compliance vs. Traditional Manual Methods

| AI-Powered Compliance | Traditional Manual Compliance |

|---|---|

| Real-time monitoring and alerts | Periodic manual reviews |

| Automated data classification and analysis | Time-consuming manual document review |

| Predictive risk assessment | Reactive compliance approach |

| 24/7 continuous surveillance | Limited by human working hours |

| Consistent application of rules | Vulnerable to human error and interpretation |

| Scales efficiently with business growth | Exponentially increasing labor costs |

| 85-95% accuracy in classification Link | Variable accuracy dependent on human factors |

| Processes millions of documents daily | Limited by manual processing capacity |

Understanding AI and Regulatory Compliance Technology

Understanding AI and regulatory compliance technology empowers companies to make strategic decisions about their risk management approach. The landscape of AI compliance technology encompasses various sophisticated tools and methodologies designed to automate, monitor, and optimize regulatory adherence across organizational functions.

According to the 2024 NAVEX State of Risk and Compliance Report, 56% of organizations plan to use generative AI within the next 12 months, with early adoption spreading rapidly as companies recognize the pressure to integrate robust solutions for managing compliance risks like data breaches, biased outputs, and regulatory violations.

Core AI Compliance Technologies

Natural Language Processing (NLP) for Regulatory Intelligence

NLP enables automated monitoring of regulatory changes across multiple jurisdictions, extracting relevant requirements and translating them into actionable policy updates. This technology processes thousands of regulatory documents, identifying changes that impact specific organizational operations and automatically flagging necessary compliance actions.

Machine Learning for Risk Prediction

Advanced machine learning algorithms analyze historical compliance data, identifying patterns that indicate potential future violations. These predictive models enable organizations to shift from reactive compliance management to proactive risk mitigation, addressing issues before they materialize into violations. Discover how AI automation strategies can enhance your organization’s predictive capabilities.

Computer Vision for Documentation Verification

AI-powered computer vision technology automates the verification of compliance documentation, from contract analysis to credential validation. This technology dramatically reduces manual review time while improving accuracy in identifying discrepancies or missing information.

Robotic Process Automation (RPA) for Routine Tasks

RPA handles repetitive compliance tasks such as data entry, report generation, and documentation filing. Organizations implementing RPA for compliance tasks report saving on compliance officers’ time, allowing professionals to focus on strategic risk assessment and complex judgment calls. Learn more about customer journey automation and how it optimizes operational workflows.

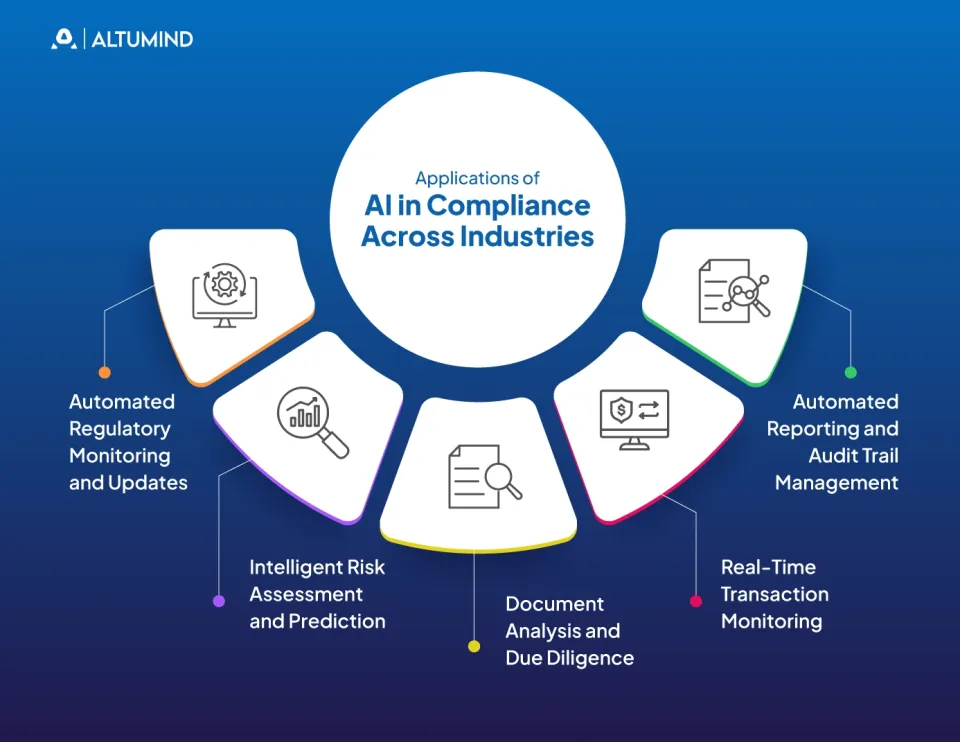

Applications of AI in Compliance Across Industries

Modern artificial intelligence compliance extends far beyond simple rule-checking. Leading organizations utilize AI-powered systems to create comprehensive compliance ecosystems that address every stage of regulatory management, from initial risk identification to ongoing monitoring and reporting.

Automated Regulatory Monitoring and Updates

The backbone of successful compliance programs lies in staying current with constantly evolving regulations. AI systems monitor regulatory bodies across multiple jurisdictions, tracking legislative changes, enforcement actions, and guidance updates in real time. These systems use natural language processing to extract relevant requirements, compare them against existing policies, and automatically generate gap analyses.

Practical Implementation: Major financial institutions deploy AI regulatory monitoring systems that track changes across 50+ jurisdictions simultaneously, processing thousands of regulatory documents monthly. These systems automatically categorize changes by impact level, affected business units, and implementation timeline, enabling compliance teams to prioritize responses effectively.

Intelligent Risk Assessment and Prediction

Organizations that used AI and automation extensively in their security workflows contained more data breaches than organizations that didn’t use these technologies. AI-powered risk assessment tools analyze vast amounts of organizational data to identify potential compliance vulnerabilities before they become violations.

Advanced Capabilities: Predictive risk models analyze historical violation data, employee behavior patterns, transaction anomalies, and external risk factors to calculate probability scores for potential compliance breaches. These models continuously learn and refine their predictions, becoming more accurate over time as they process additional organizational data.

Document Analysis and Due Diligence

Advanced NLP capabilities enable AI systems to review contracts, policies, and documentation at scale with unprecedented accuracy. A large metropolitan hospital network implemented an NLP-powered AI compliance monitoring system that automatically audits clinical documentation, achieving a 60% reduction in documentation errors and a 40% drop in compliance incidents within the first year, while simultaneously cutting manual review costs.

Contract Intelligence Applications: AI contract analysis tools extract key terms, identify compliance obligations, flag non-standard clauses, and monitor expiration dates across thousands of agreements. These systems compare contract terms against regulatory requirements and organizational standards, automatically identifying potential compliance risks in vendor relationships, customer agreements, and partnership arrangements.

Real-Time Transaction Monitoring

Financial institutions and heavily regulated industries benefit from AI’s ability to monitor transactions continuously, flagging suspicious activities that might indicate fraud, money laundering, or other compliance violations. This proactive approach significantly reduces regulatory risk while improving operational efficiency.

Behavioral Analytics: Modern transaction monitoring systems employ behavioral analytics that establish baseline patterns for normal activity across different user profiles, transaction types, and time periods. Any deviation from established patterns triggers alerts, enabling compliance teams to investigate potential violations before they escalate.

Automated Reporting and Audit Trail Management

AI systems automatically generate compliance reports, maintaining comprehensive audit trails that document all compliance activities, decisions, and justifications. This automated documentation proves invaluable during regulatory examinations and internal audits.

Audit Readiness: Organizations implementing continuous AI-driven compliance monitoring reduce audit preparation time, as all necessary documentation is automatically maintained and readily accessible. These systems ensure that evidence collection, report generation, and regulatory submission requirements are handled automatically, reducing compliance team workload while improving submission accuracy.

Critical Challenges in AI Compliance Implementation

While AI in compliance offers transformative benefits, organizations must navigate significant challenges to achieve successful implementation. Understanding these obstacles enables proactive planning and risk mitigation, increasing the likelihood of implementation success and sustainable value realization.

Algorithmic Bias and Fairness

One of the most significant risks of AI is algorithmic bias, where AI systems unintentionally produce unfair or discriminatory outcomes. This challenge proves particularly problematic in compliance contexts where biased AI could lead to discriminatory enforcement, unfair treatment of certain populations, or violation of anti-discrimination laws.

Data Privacy and Security Vulnerabilities

AI-powered systems handle vast amounts of sensitive data, making them attractive targets for cyberattacks. New vulnerabilities arise when AI is used to analyze and manage data, particularly when cybercriminals leverage AI to exploit those weaknesses. Organizations must prioritize strict data protection measures, including encryption and secure data storage, to prevent breaches and unauthorized access.

Model Transparency and Explainability

The complexity and opacity of AI models make accountability and transparency hard to enforce, complicating regulatory efforts and stakeholder trust. Compliance contexts demand explainability, the ability to understand and articulate why AI systems made particular decisions or recommendations.

Regulatory Uncertainty and Fragmentation

AI compliance involves meeting a variety of international regulations, such as the EU AI Act and US Executive Orders. Each of these regulations has unique requirements that are constantly evolving, creating a complex landscape for organizations operating globally. Compliance demands careful alignment of AI systems with the specific legal frameworks of each region to avoid penalties and legal issues.

The EU AI Act classifies AI systems into four levels of risk: unacceptable, high, limited, and low, with each category carrying specific regulatory obligations. High-risk AI systems require more stringent compliance measures, including thorough documentation and transparency protocols. However, it is challenging to assess the risk level of each AI system and ensure that it meets the corresponding regulatory requirements.

Cross-Functional Collaboration Challenges

AI compliance requires collaboration across multiple teams, including legal, data governance, and technical development. Broad organizational commitment and involvement from senior leadership are essential to establish compliance as a priority across all functions and to secure the necessary resources.

Essential Considerations for AI Compliance Implementation

Successful AI in compliance implementation requires careful planning and attention to industry-specific requirements. These considerations ensure that AI investments deliver maximum return while maintaining regulatory adherence and stakeholder confidence, positioning organizations for long-term compliance excellence.

Governance Framework Development

Organizations must establish clear accountability structures for AI decisions, implement board-level oversight and reporting, create cross-functional AI steering committees, establish regular performance and ethics reviews, and develop incident response and escalation protocols.

Critical Governance Elements:

- Executive sponsorship, ensuring adequate resources and organizational priority.

- Clear decision rights defining who approves AI system deployment and changes.

- Risk appetite statements articulating acceptable AI risk levels.

- Performance monitoring, tracking AI system effectiveness, and compliance.

- Continuous improvement processes incorporate lessons learned and evolving best practices.

Building Essential AI Compliance Capabilities

Technical Infrastructure Requirements:

- Robust data governance ensures data quality, lineage, and access controls.

- Secure computing resources, whether cloud-based or on-premises infrastructure.

- Integration capabilities connecting AI with existing compliance and operational systems.

- Version control and model management tools track AI system changes over time.

- Monitoring and alerting infrastructure, detecting performance degradation or anomalies.

Organizational Capabilities:

- AI literacy training for compliance teams, building understanding of AI capabilities and limitations.

- Data science and machine learning expertise, either internal staff or external partnerships.

- Ongoing education on regulatory developments, maintaining current knowledge of compliance requirements.

- Cross-functional collaboration skills bridging technical and business domains.

Integration with Existing Compliance Programs

Modern organizations require seamless integration between AI systems and established compliance frameworks. This integration enables dynamic risk assessment, automated reporting, and enhanced decision support across all compliance activities, ensuring that AI enhances rather than disrupts existing compliance processes.

Integration Best Practices:

- API-first architecture enabling flexible connectivity between systems.

- Common data models ensure consistent information across platforms.

- Unified user experience, reducing training requirements, and improving adoption.

- Consolidated reporting provides comprehensive compliance views.

- Workflow automation connecting AI insights to remediation actions.

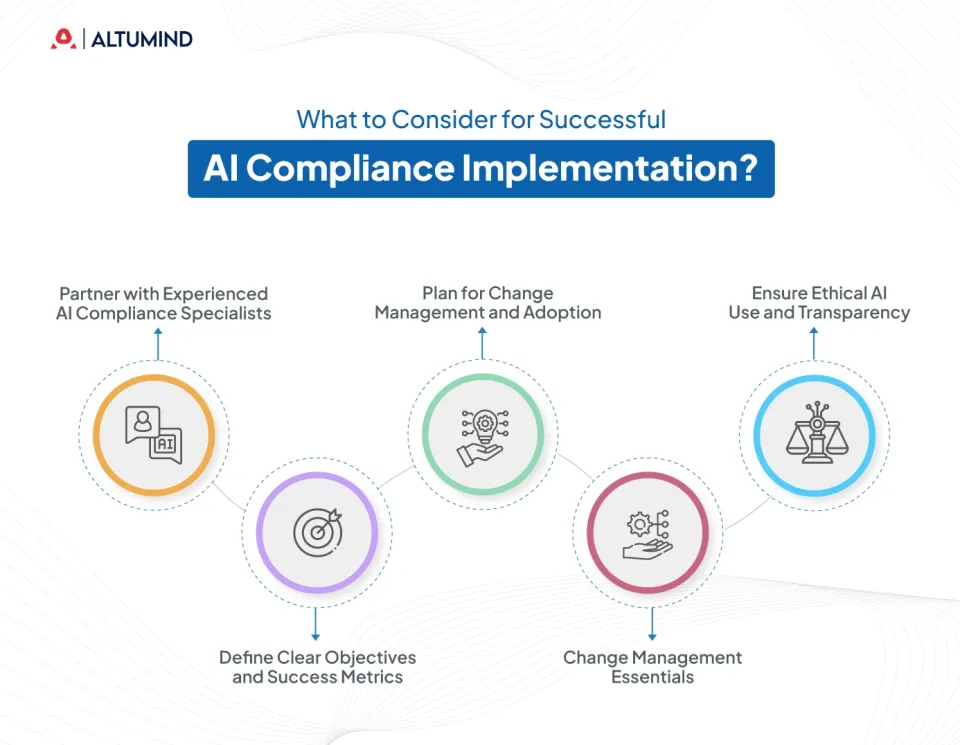

What to Consider for Successful AI Compliance Implementation?

To fully leverage the advantages of AI in compliance and ensure seamless integration with your existing regulatory management strategy, consider these comprehensive implementation guidelines that address technical, organizational, and strategic dimensions of successful AI compliance deployment.

Partner with Experienced AI Compliance Specialists

Successful implementation begins with selecting technology providers and consultants who understand both AI capabilities and regulatory requirements in your specific industry. Look for partners with proven experience in your regulatory environment, demonstrated success with similar organizations, technical expertise in relevant AI technologies, and an understanding of industry-specific compliance challenges.

Evaluation Criteria:

- Client references and case studies from comparable organizations.

- Regulatory knowledge and relationships with industry supervisors.

- Technical capabilities and innovation track record.

- Implementation methodology and project management approach.

- Ongoing support and continuous improvement commitment.

Define Clear Objectives and Success Metrics

Organizations must establish concrete goals for their AI compliance initiatives before deployment, ensuring alignment between technology capabilities and business needs. Specific objectives should include compliance processes to be automated, target reduction in manual effort and associated costs, desired improvement in risk detection rates and false positive reduction, a timeline for achieving measurable results, and scalability requirements for future growth.

Success Metrics:

- Quantitative KPIs, including cost savings, time reduction, accuracy improvement, and violation rate decrease.

- Qualitative measures such as user satisfaction, audit performance, and regulator feedback.

- Risk metrics tracking near-misses, incidents prevented, and exposure reduction.

- Operational metrics monitoring system availability, processing speed, and data quality.

Establish Robust Testing and Validation Processes

AI compliance systems demand rigorous validation to ensure accurate risk detection, minimize false positives that waste investigative resources, and maintain stakeholder confidence in AI recommendations. Testing protocols should encompass multiple validation stages throughout the AI lifecycle.

Comprehensive Testing Framework:

- Pre-deployment model validation, including accuracy testing, bias assessment, and stress testing.

- User acceptance testing ensures compliance professionals can effectively use the system.

- Ongoing performance monitoring, tracking metrics against baseline, and identifying degradation.

- Regular bias and fairness assessments evaluating outcomes across different populations.

- Stress testing under various scenarios, including extreme conditions and edge cases.

- Third-party independent validation provides an objective assessment of AI systems.

Plan for Change Management and Adoption

While three out of five corporate risk and compliance professionals feel confident about their ability to address compliance risks, the top three obstacles cited were a lack of knowledgeable personnel, inadequate resources, and poor company culture. Successful adoption requires addressing these human and organizational factors alongside technical implementation.

Change Management Essentials:

- Executive sponsorship and visible commitment are demonstrated through resource allocation and communication.

- Clear communication about benefits and changes using multiple channels and formats.

- Training programs for all affected stakeholders are tailored to different roles and skill levels.

- Mechanisms for feedback and continuous improvement, creating channels for user input.

- Recognition and rewards for adoption leaders, celebrating early adopters, and successful implementation.

- Patience and persistence, acknowledging that cultural change takes time.

Ensure Ethical AI Use and Transparency

Organizations must prioritize ethical considerations in AI compliance implementation, recognizing that responsible AI use is now a reputational issue. Meeting compliance standards shows that organizations take safety, privacy, and ethical risks seriously, building trust with customers, regulators, and other stakeholders.

Ethical AI Principles:

- Transparency in how AI makes compliance decisions, enabling understanding and validation.

- Fairness and non-discrimination in automated processes, ensuring equal treatment

- Privacy protection in data handling respects individual rights and minimizes data collection.

- Human oversight for high-stakes decisions, maintaining accountability for important outcomes.

- Security safeguards protect AI systems from manipulation or unauthorized access.

- Continuous ethical review assessing AI impact on stakeholders and society.

Why Choose Altumind for AI Compliance Solutions?

Altumind specializes in AI and machine learning platforms with certified experts, data scientists, and pre-trained models for compliance across finance, supply chain, HR, and IT departments. Our expertise in natural language processing, deep learning, and predictive analytics delivers domain-specific solutions that optimize operations and enhance automation and predictive insights for data-driven compliance decision-making. Partner with us if you’re planning to transform your compliance operations with proven implementation methodology and scalable AI solutions.

Conclusion

AI in compliance has evolved from experimental technology to an essential risk management component. Organizations embracing this transformation position themselves for competitive advantage, while those delaying face mounting regulatory risk and escalating costs. The future of compliance is intelligent, proactive, and AI-powered. Hence, organizations acting now will establish industry leadership while building lasting trust with regulators and stakeholders.

Successful enterprise IT solutions implementation requires careful planning and execution. Follow these proven steps to ensure optimal results and maximize return on investment while minimizing risks throughout the transformation journey.

Table of Contents

- Introduction

- Why Do Organizations Need AI in Compliance

- AI Advantages for Compliance vs. Traditional Manual Methods

- Understanding AI and Regulatory Compliance Technology

- Core AI Compliance Technologies

- Applications of AI in Compliance Across Industries

- Critical Challenges in AI Compliance Implementation

- Essential Considerations for AI Compliance Implementation

- What to Consider for Successful AI Compliance Implementation

- Why Choose Altumind for AI Compliance Solutions?

- Conclusion

Let's Connect

Reach out and explore how we can co-create your digital future!